Reality check: gamers prefer minimal interruptions from ads while playing. There’s good news for gaming publishers: advancements in ad tech can address monetization challenges and enhance the overall user experience for players — all while running ads. Understanding user demographics, preferences, and behavior means that we can better tailor ad strategies to enhance engagement while ensuring ads remain effective. Let’s review key strategies to improve the gaming ad experience for users while maintaining performance for publishers.

Know your user: understanding demographics and preferences

To craft effective ad experiences, it’s crucial to know your audience and understand what influences their behavior. Factors such as age, gender, location, and economic climate play significant roles in shaping user attitudes towards ads. The latest data from eMarketer shows that the age and gender composition of gamers is shifting significantly.

- Millennials and older Gen Zers (25-34 years) gamers are still predominant, holding steady at around 17% of digital gamers.

- The ranks of younger Gen Z (18-24 years) and female digital gamers are growing quickly. Gen Z gamers will grow 4.1% in 2024, and female gamers are set to outpace male gamers in terms of growth.

- Older gamers (45-65 years) have gotten in on the fun, now making up about 10% of gamers.

- The small but mighty number of gamers aged 65+ is expected to triple in 2024, hitting 3.6% compared to 1.2% in 2023.

More diverse age of users as well as parsed residence is pushing developers to be more sophisticated in the choice of ad creatives, ad placement, and ad frequency to match their preferences. 74% of non-paying users from younger generations and Tier 2/Tier 3 countries mainly enjoy ads with reasonable frequency capping — and even tend to make more purchases from the brands advertised. However, engagement and retention of older generations in the same scenario could decrease dramatically; this demographic group tends not to tolerate too many ads.

Another notable demographic shift is geography, with Tier 2 and Tier 3 countries emerging as significant players. Mobile gamers are booming across MENA (Turkey, Saudi Arabia), APAC (India, Thailand, China), and EMEA (Nigeria, South Africa), with 92% of them gaming every day.

Tailor your ad formats and placements

Different game types demand tailored ad approaches. Hyper-casual and casual mobile games thrive on a mix of ad formats, including banners, interstitials, and rewarded videos.

Mid-core and hard-core PC/console and mobile games tend to focus more on less intrusive ad options like rewarded or in-game ads that appear less frequently. Gaming publishers can consider testing banners, but they should be less represented than other formats. Issues with clickability of in-game ads can be balanced there by ad revenues coming from rewarded and banner ads.

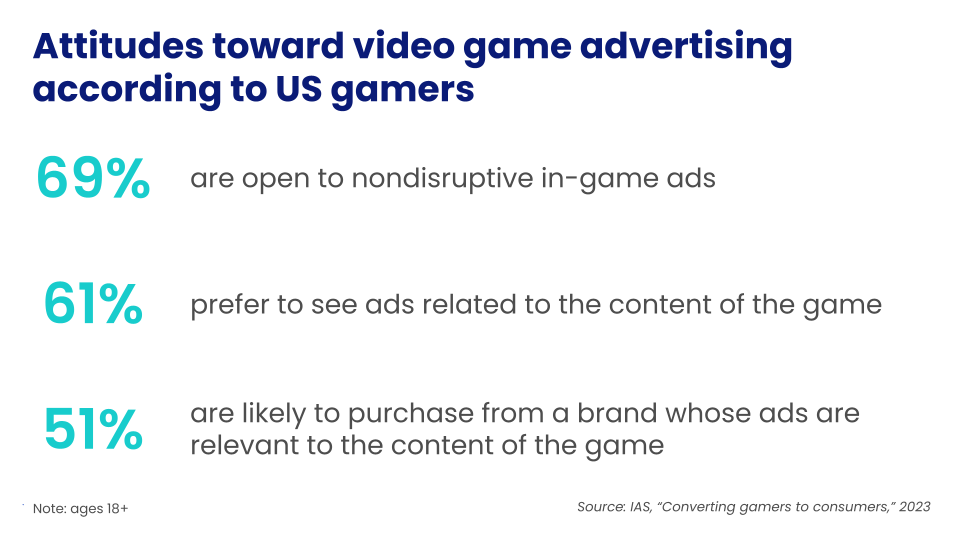

According to an IAS report, today more than 60% of users are open to non-disruptive ads that are related to the content of the game.

Enhance engagement across channels: the omnichannel approach

There’s a recent tendency for publishers across all game types to reconsider display ads and, therefore, add more display ad placements in an effort to increase their overall ad revenue without disrupting the user experience.

The return to display advertising boosted the popularity of flip banners or a banner containing a 3D flip that reveals another image with additional details about an offer. This format increases user engagement because this dynamic feature creates a separate interaction between user and ad.

In-game ads — one of the most non-disruptive ad formats to users and a newer form of display presentation — also greatly improve user experience and high-level brand awareness. However, while publisher revenues and user retention tend to be high for this format, the demand can be inconsistent. This is largely because click-through rate (CTR) is a prioritized KPI for marketers, but in-game ads aren’t as clickable as some other formats. Fill rate is definitely an area for improvement here.

Big opportunities lay ahead for ad monetization activities, including:

- Exploring private marketplace deals (PMPs) and preferred deals

- Publishing games across connected TV devices (CTV)

- Building audiences on the brink of an ID-less world.

Preferred deals can bring higher eCPMs and better fill as well as secure ad quality. As games begin to reach bigger screen sizes such as smart TVs, preferred deals could have a significant impact on facilitating this transition.

With users engaging across multiple devices, adopting an omnichannel approach can significantly boost engagement and ad performance. 72% of console or PC gamers play on more than one platform. Diversifying ad formats based on device usage can further enhance user engagement.

Use what you have: first-party data for behavioral and contextual targeting

Publishers can deliver more relevant ads to their audiences by using first-party data for behavioral and contextual targeting. For addressing the ID-less and cookieless world, leveraging first-party data is one of the essential strategies for marketers and publishers alike. In-gaming publishers can use behavioral information — such as in-app actions, time of day, purchase history — to tailor ad experiences within the app.

According to eMarketer, 61% of gamers in the US mentioned that they prefer to see ads that are related to the content of the game the are playing.

Advanced targeting options such as geo-fencing and contextual ad technology can also enhance ad relevance and effectiveness.

Apple’s ATT and the end of device fingerprinting challenge user identification and advertising/monetization in general. Users have become more sensitive and demanding when it comes to ad content. For the foreseeable future, exploring contextual solutions and UIs, as well as education about more effective use of first-party data, will likely be inevitable.

Embrace flexibility and testing

Maintaining open communication and transparency among publishers, ad networks, and demand partners is essential for optimizing ad strategies.

From the SSP perspective, we’re really honing in on empowering our publishers and demand partners with greater control, all the while prioritizing user experience. Here’s the breakdown: developers and publishers get to manage the general settings, while demand partners and advertisers focus on bidding for inventory that aligns best with their campaign objectives.

And you know what? It never hurts to explore new ad units, integrations, and buying models for publishers and developers. We’re all about sharing insights and best practices, paving the way for improved revenues without sacrificing user retention and engagement.

Embracing a culture of testing allows for continuous refinement of ad formats, placements, and buying models to adapt to evolving user behaviors. 85% of gamers confirm that the most user-engaging formats remain interstitial and rewarded video.

Putting it all together

If you’re a gaming publisher, you’re probably already using one of the strategies (at least) we’ve just discussed. But more is more, and it’s worth exploring how to implement all five of these strategies holistically. With all five working together, publishers can create gaming ad experiences that are not only engaging but also respectful of user preferences. It’s a win-win that ultimately leads to improved performance and user satisfaction.