Have you read the latest Digital Ad Tech Trends Report from Smaato? We’re excited to share a glimpse into the report. Get ahead of the trends impacting the digital ad tech industry to help shape your monetization strategy and extend your reach.

Enjoy a preview of some of the topics we cover.

5 Key Trends in Digital Ad Tech

In the 55-page report, we go into detail on some major emerging trends in the digital ad tech landscape including:

We’ll share a sneak peek into some of the discoveries, too.

What You’ll Learn in the 2021 Digital Advertising Trends Report:

- Dive into the impact of the COVID-19 pandemic on digital verticals like Fintech, digital communication apps, mobile gaming apps, health/fitness, eCommerce, and more

- The best ad formats to keep users engaged and to improve your monetization strategy

- The pros of programmatic bidding and how header bidding can improve reach and eCPMs

- Key tips for formulating a strong OTT/CTV monetization strategy

- Trending malicious ad fraud schemes

- How first-party data is gaining traction in a cookieless world

- Ways to maintain compliance with shifting user-privacy policies

And more! Get a preview below of some of what we cover:

How is Digital Advertising Tech Evolving Post-Pandemic?

Digital Ad Tech is rapidly changing to keep up with an Increasingly Digital World

Any trend report would be remiss to exclude a thorough analysis of how the pandemic has altered not only history but also the future.

In this report, we dive into the impact in specific areas, including ecommerce, fintech, health and wellness, and grocery/food shopping, while fueling digital adoption for remote working, learning, and gaming.

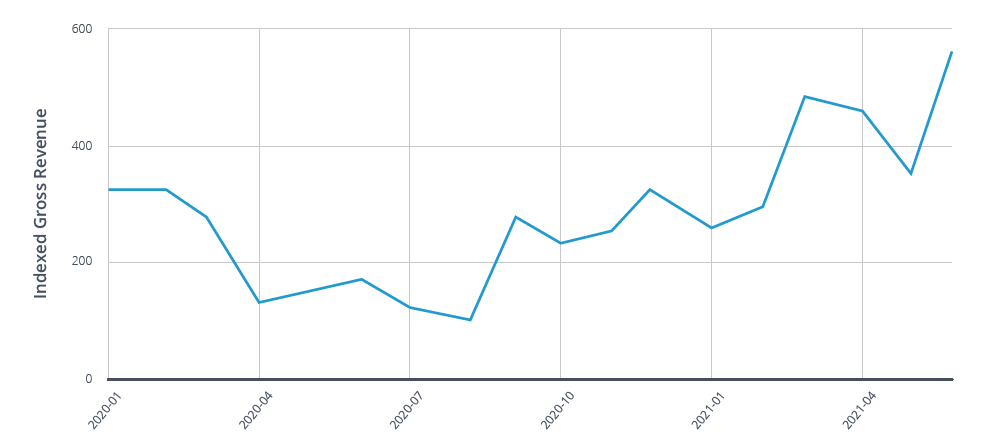

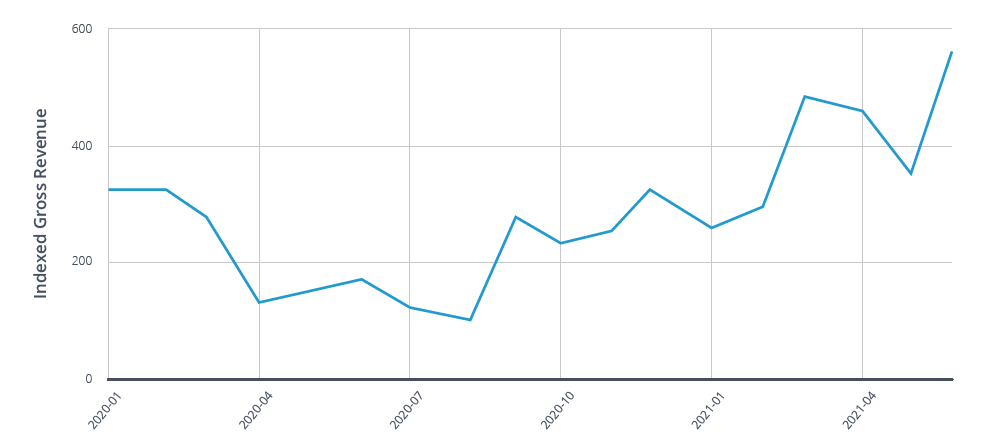

Health & Fitness App Gross Revenue

Worldwide, 2020 – H12021

click to enlarge

Source: Smaato Publisher Platform, 2021

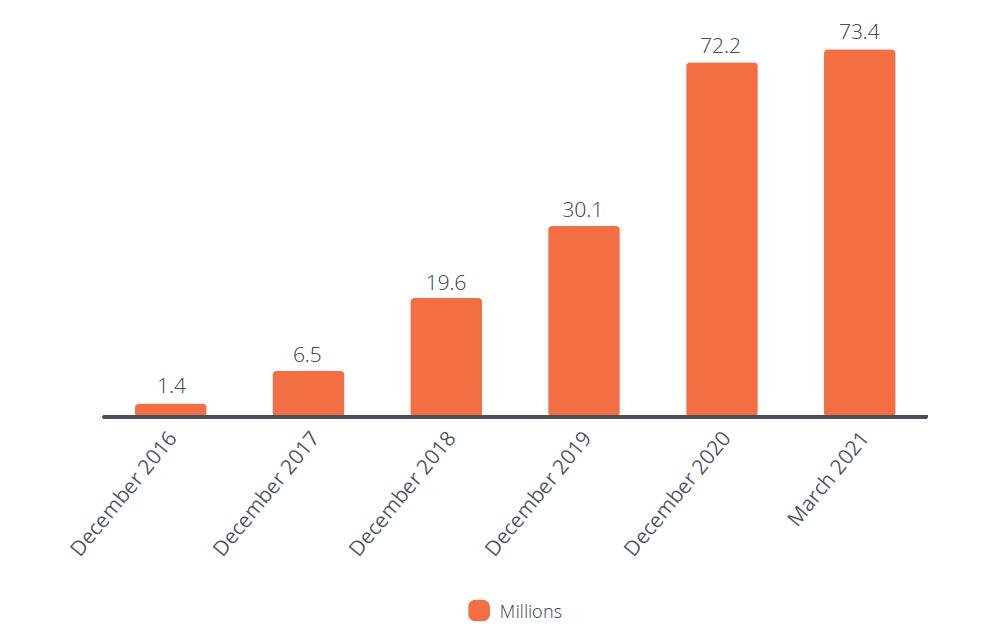

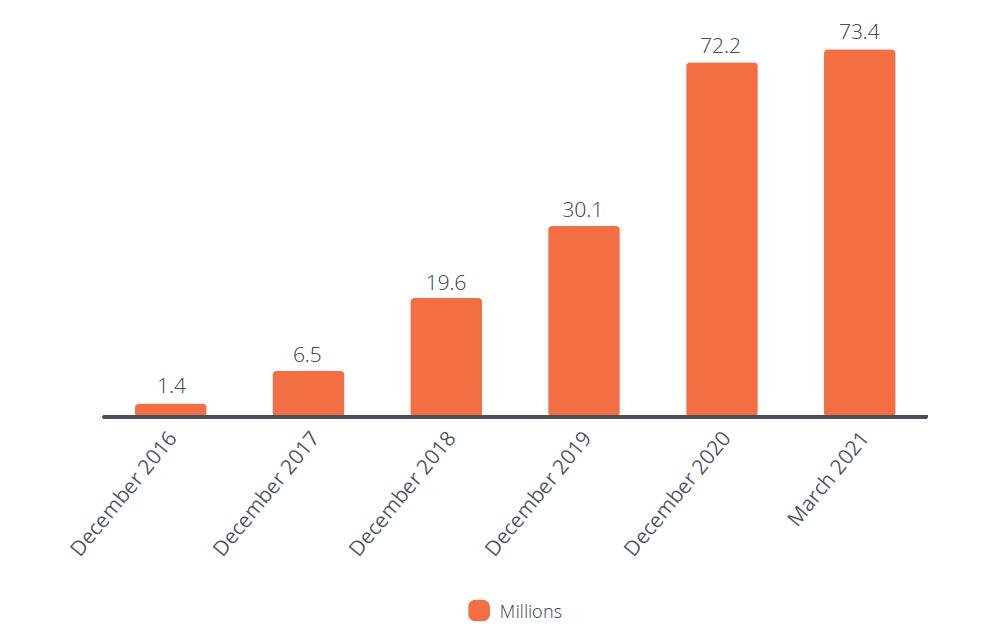

Rather than focus on the negative impacts of the pandemic, our report examines the ways in which a more complete shift to a digital lifestyle has expedited online trends, and forced the ad tech industry to evolve quickly in order to keep up. For example, lockdown restrictions actually expedited the digital adoption trend, as can be seen by the monthly active WeCom (WeChat Work) app users in China:

Monthly Active WeCom (AKA WeChat Work) App Users

China, December 2016-March 2021

click to enlarge

Source: QuestMobile, April 2021

You’ll see trends across verticals, as well as the impact (and steady recovery) of more negatively affected categories, like the travel industry.

What are the benefits of OTT/CTV Advertising for Publishers and Marketers?

OTT/CTV (streaming video online) has been gaining momentum for awhile, but this is just the beginning.

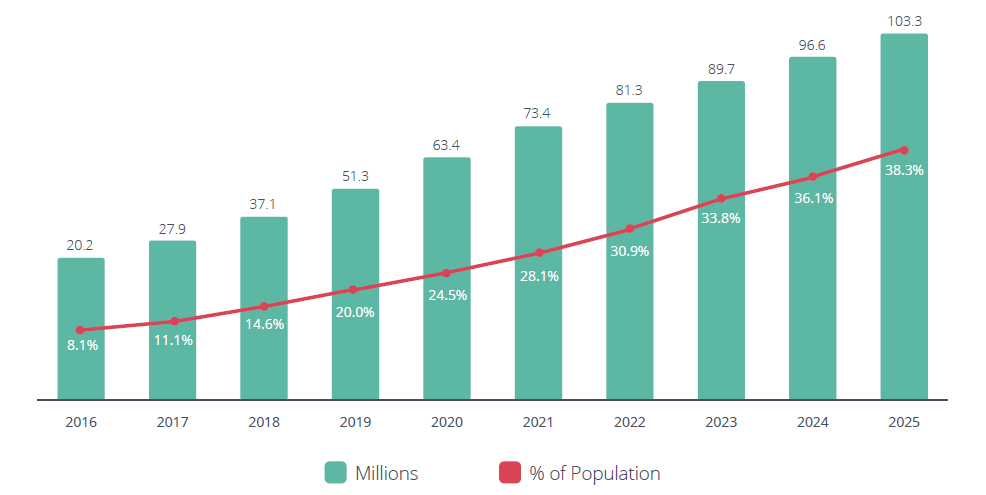

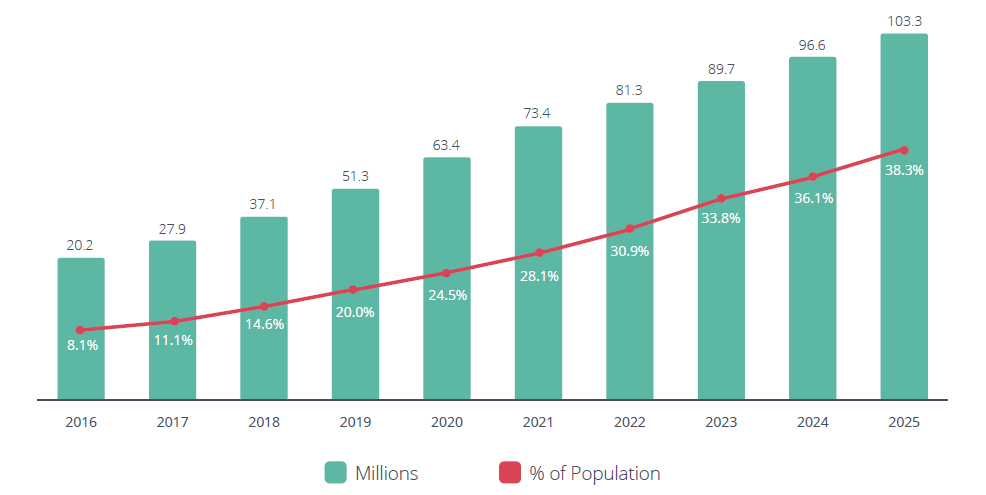

According to eMarketer, by 2025 nearly 40% of households will have cut the cord, shifting from traditional cable and satellite subscriptions to internet-streamed TV.

Cord Cutters

US, 2016-2025

click to enlarge

Source: eMarketer, February 2021

The reliance on OTT/CTV is just beginning. As 5G sweeps the globe, lightning fast streaming speeds, reduced latency, and better quality on the go will further fuel OTT’s success.

Publishers and marketers recognize the opportunity to reach a highly-engaged audience based on what they like to watch rather than who they are.

“Since we started using Smaato’s OTT/CTV Advertising Platform our content monetization has improved significantly, the fill is high (~85-97%)! They give us the ability to control content experiences and demand sources on both the commercial break and individual commercial level, as well as allow us to sell our inventory as commercials or as pods. Smaato’s solution is perfect for any type of OTT publisher, developer, broadcaster, or network!”

Tony Kandah

FlixHouse

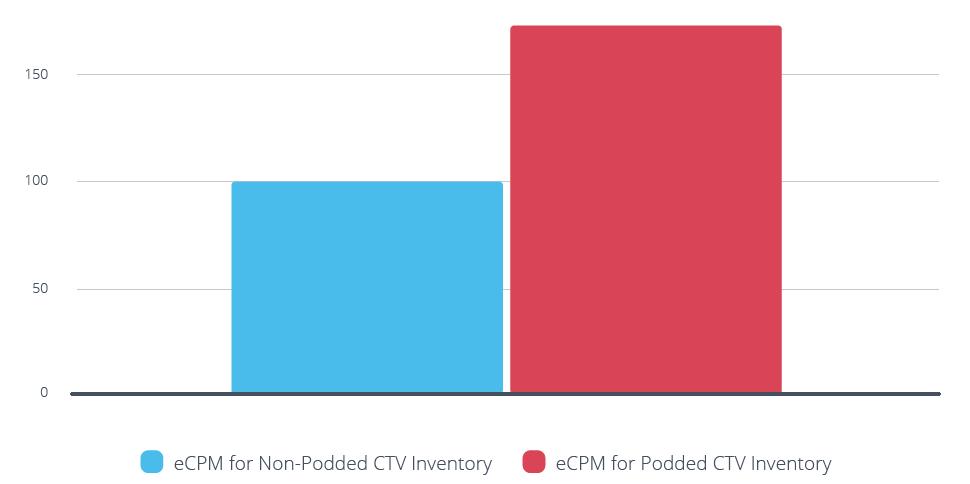

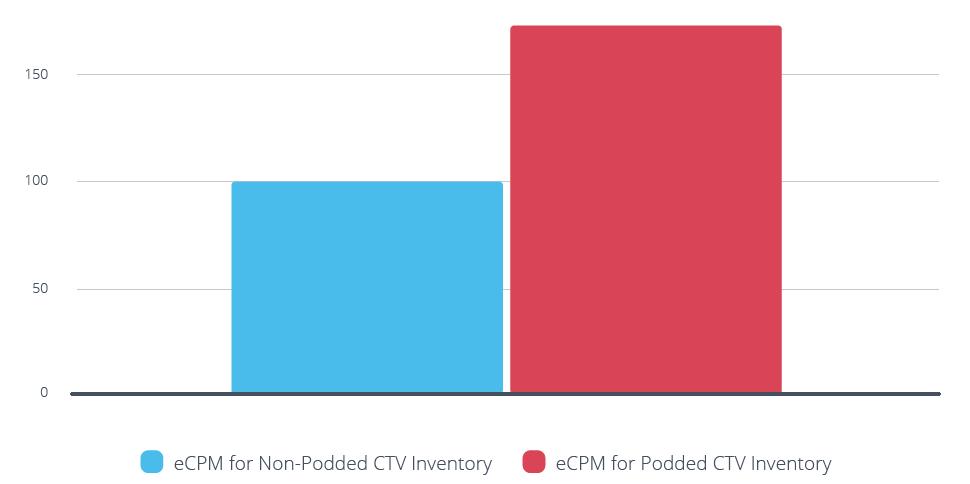

Smaato’s unique OTT Advertising Platform offers all kinds of solutions for publishers and marketers. In the 2020-2021 Trends Report, we share how our solutions can help marketers reach specific audiences, while helping publishers monetize their inventory. We also go into detail about how different ways to auction OTT/CTV inventory can generate higher eCPMs. Download your copy to see all the benefits of OTT/CTV advertising.

Indexed eCPM for Non-Podded vs. Podded OTT/CTV Inventory on Smaato’s Platform

Indexed before eCPM

click to enlarge

Source: Smaato Publisher Platform, 2021

If you’d like to learn more about the history of OTT/CTV and monetization opportunities for publishers, check out our complimentary guide: OTT/CTV Advertising eBook.

Read On

How Does Delivering Experiences Improve Brand Sentiment and Engagement?

Gone are the days of CTR as the only KPI. Learn why delivering positive user experiences is key to long term success.

From innovative new ad formats to a shift in how marketers and publishers measure success, learn why brand favorability is changing advertising strategies around the globe.

A major theme? Giving users/viewers more control over their advertising interaction and delivering more tailored experiences helps improve brand sentiment. After all, users will favor applications, websites, and content that gives them control over their adverstising experience. In fact, Integral Ad Science found that delivering more relevant ads improves favorability by 107%. This means users are more likely to engage with advertisements, while maintaining a positive feeling about the publisher’s application, website, or platform.

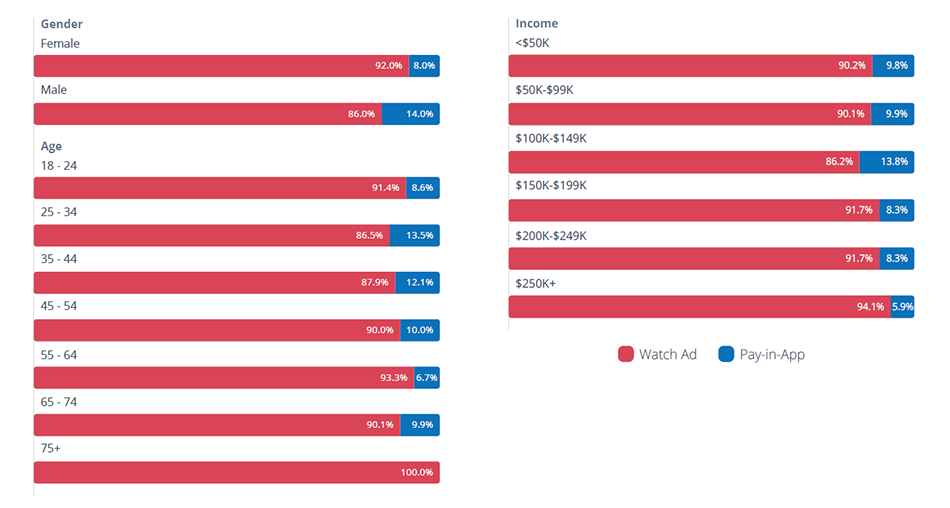

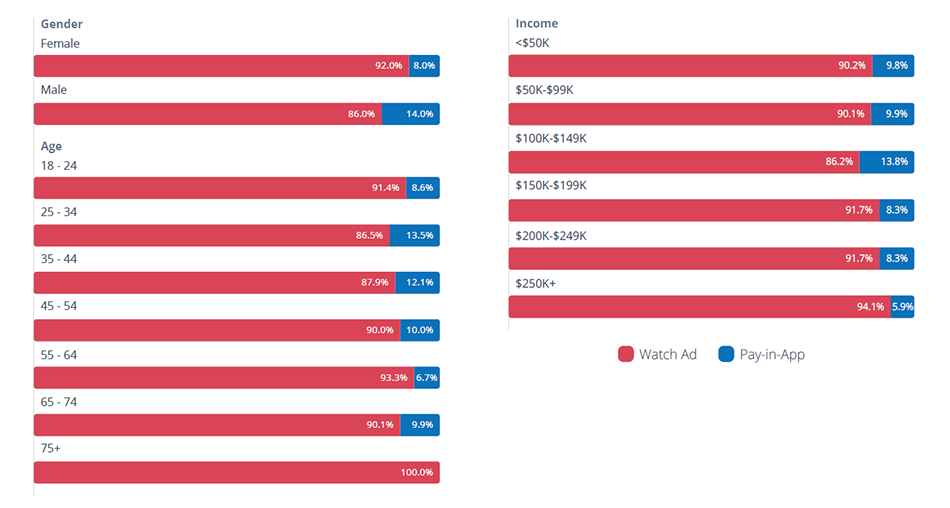

While ads can sometimes be an unwelcome interruption, users would almost always prefer to engage with ad content than make an in-app purchase:

Would US Mobile Gamers Prefer to Watch Rewarded Video Ads or Pay for In-App Purchases? US, Q2 2020

By Demographic

click to enlarge

Source: DSIQO, September 10, 2020

In our trends report we dive into key ad formats that help engage audiences with a less obtrusive experience, including deep linking and splash ads, shoppable ads, and rewarded video outside of gaming.

- Splash Ads: Full-screen, eye-catching interstitials that fill an app launch screen as the app content loads. These ads deliver high engagement with easy-to-measure viewability.

- Deep Links: Embedded URLs that drive a mobile app user to in-app content. There are three types of deep links: standard deep links, deferred deep links, and contextual deep links.

- Shoppable Ads: Interactive ads allow users to directly purchase the product featured in the ad. These video or image ads have embedded tags that link directly to the product’s page on the marketer’s website.

- Rewarded Video: 15-30 second, non-skippable video interstitials that reward users with in-app rewards upon ad completion. Users opt in to these incentivized video ads.

As users and viewers opt in to engaging with ads, brand sentiment improves, user experience improves, and the likelihood of conversion increases.

Why is Programmatic Bidding Growing so Rapidly?

Programmatic Bidding Gives Publishers more flexibility and more control over their inventory, while Marketers extend their reach.

In the report, we go into detail about the benefits of programmatic bidding, header bidding solutions, and why, according to data from the Smaato Platform, in 2021, eCPMs for direct marketplace deals (including private exchange and preferred deals) were 18% higher than for open exchange deals.

Here’s a quick refresher on the four main programmatic ad buys (open auctions, private marketplaces, preferred deals, and guaranteed deals):

Best for Scale: The Original Programmatic Marketplace, Open Auction

Also Known As: Open Exchange, Real-Time Bidding (RTB), Open Marketplace, Smaato Exchange

As the name suggests, open auctions are open to all. All marketers on the exchange/SSP/ad network have an opportunity to bid on all available publisher inventory. This is the most traditional form of programmatic auctions.

With real-time bidding, publishers can set the floor price for an ad, but the marketer demand still determines the final price, and the highest bid wins. Inventory is not guaranteed.

Historically, Open Auctions came with some risks. Publishers wouldn’t always know who was purchasing the inventory, which could hurt their brand image. Meanwhile, inventory isn’t necessarily disclosed, so marketers didn’t always know what they’d be getting. At Smaato, we share IDs with our partners to help improve transparency in the RTB process.

Best for Offering Premium Inventory to Relevant Advertisers: Private Exchange

Also Known As: Private Marketplace (PMP), PMP Programmatic, Private Auction, Invitation-Only Auction

A private exchange is another form of real-time bidding, but instead of being open to all marketers and all publishers, a single publisher invites a mere handful of marketers to participate.

Private exchanges are quickly becoming industry standard. In 2020, US ad spend in private exchanges outpaced open auctions for the first time.1

To access the auction, these hand-selected marketers will need a time-sensitive deal ID. Publishers set a floor price, and the bidding starts there. As in the open auction, the highest bid wins. Inventory is not guaranteed.

Best for a First Look at Premium Inventory: Preferred Deal

Also Known As: Unreserved Fixed Rate, Programmatic Non-Guaranteed

A Preferred Deal is a private, 1:1 relationship between a publisher and a marketer. In a Preferred Deal, publishers offer premium inventory to the marketer at a pre-negotiated fixed eCPM price.

While eCPMs are a bit higher, marketers are paying to get what’s essentially “first dibs” on premium ad space. When an ad request comes through, a marketer with a preferred deal has an opportunity to bid at the pre-negotiated fixed eCPM price in real time, before the inventory heads to open auction. Inventory is not guaranteed.

Best for Guaranteed Impressions and Set Budgets: Programmatic Guaranteed

Also Known As: Guaranteed Buy, Programmatic Direct, Automated Guaranteed

With a guaranteed buy, a publisher offers specific, reserved inventory to a marketer at a fixed price.

Publishers and marketers negotiate a price for a guaranteed volume of impressions, or flight date. This is similar to a direct sale/buy, but programmatic automation replaces the manual IO process, improving efficiency and reducing error.

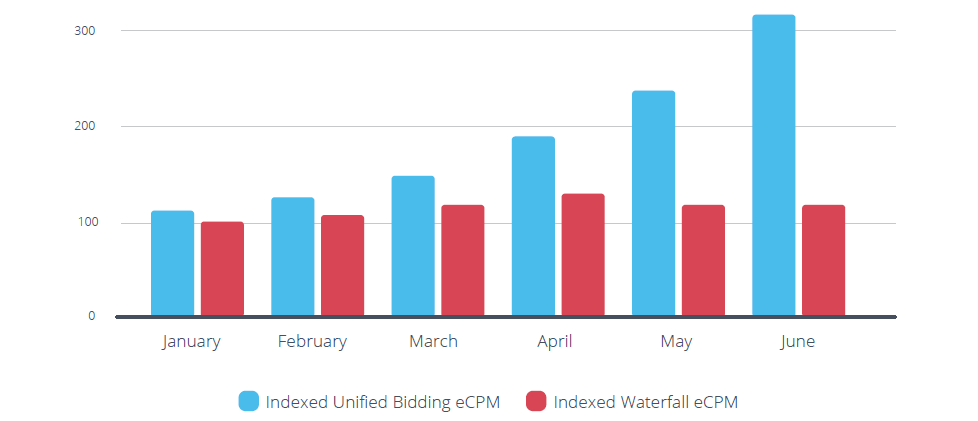

Meanwhile header bidding solutions are also quickly becoming a favorite among publishers and marketers alike. Marketers love header bidding solutions because it gives them a chance to compete in the auction, while publishers love header bidding solutions because they ensure better fill and higher eCPMs.

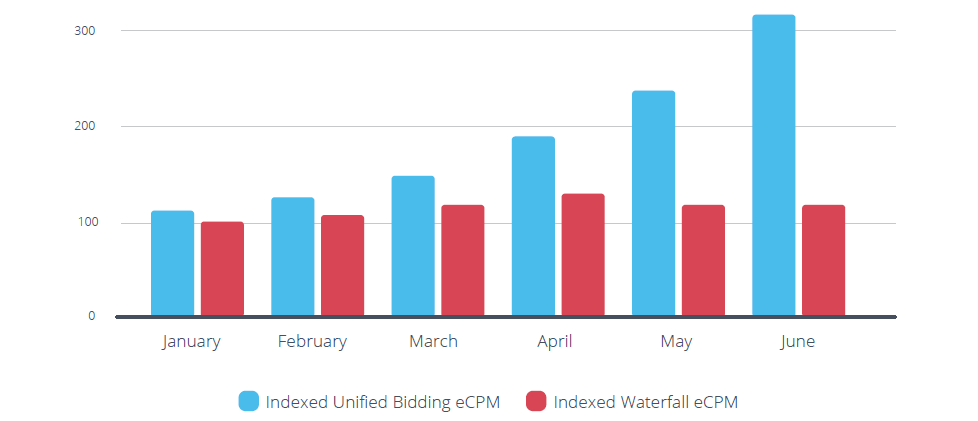

Smaato’s in-app header bidding solution, Unified Bidding, delivers up to 230% higher revenue compared to other integrations.

In fact, publishers using Smaato’s header bidding solution enjoy greater fill and higher eCPMs across the board.

Indexed eCPM for Unified Bidding vs. Exchange for one Publisher on the Smaato Platform

H1 2021

click to enlarge

Source: Smaato Publisher Platform, 2021

One publisher, for example, enjoyed 14x more fill with Unified Bidding than with the traditional waterfall.

How can you Maintain Compliance with Ever-Changing Privacy Laws?

Plus, learn why first-party data is key to delivering outstanding, relevant experiences without violating user privacy.

Crucial players like Apple and Google are leading a consumer movement towards increased privacy and data controls. As legislation like the GDPR, CCPA, and CPPA take hold, user privacy protection becomes not only the right thing to do, but a legal requirement, as well.

At Smaato, we take user privacy seriously. We’ve built our platform to allow publishers to manage their own first-party data, to ensure user privacy preferences are protected and respected.

In our Trends Report, we dive into the impacts of policy changes like iOS 14.5 and solutions like SKAdNetwork, to help ensure campaigns get properly attributed while maintaining compliance. Learn how audience targeting can help marketers reach audiences based on what they watch or engage with rather than who they are, and see how the crumbing cookie is paving the way for more relevant contextual opportunities for publishers and marketers alike.

And more!

There’s so much more to see. We’ve also partnered up with Geoedge to bring you the latest update on current ad fraud schemes, while sharing examples of how partners like Smaato can help protect your brand.

Publishers, read the report to get familiar with each of these growing ad tech trends to help inform your advertising monetization strategy. Marketers, advertisers and DSPs, download your copy to learn how to engage audiences, and deliver ROI for your campaigns.

Download the Complete Report